Message from the Board of Directors

In 2023, the global economy faced significant volatility from the Russia-Ukraine conflict, Middle East tensions, rising interest rates, high inflation, fluctuating energy prices, a petrochemical trough, and the slow recovery of China and ASEAN. Likewise, Thailand’s increasing risks from surging energy and electricity costs affecting all sectors.

SCG restructured to boost agility and resilience amid economic volatility, focusing on robust financial health, efficient cost control, and a shift towards greener energy by using more clean and renewable sources. This approach aims to reduce costs, seize opportunities in crisis, invest in high-growth businesses, and move towards a low-carbon society. SCG is ready to harness global market opportunities in clean energy, green innovation, healthcare, smart living, and digital logistics, ensuring customers enjoy a lifestyle that is “valuable, convenient, safe, and green.”

|

|

|

| |

Restructuring Business Groups for Enhanced Agility in Creating Innovation and Fast Responsiveness

Restructuring Business Groups for Enhanced Agility in Creating Innovation and Fast Responsiveness

|

|

|

|

|

| |

| |

|

|

|

|

|

SCG restructured its business groups with an Agile Organization model, fostering new businesses with high growth potential aligning with global trends and business conditions. This adjustment enables SCG to quickly adapt to ever-changing customer demands.

SCG Cement and Green Solutions has elevated the ASEAN construction industry by promoting construction innovations and green technologies, responding to the surge in green construction practices. This includes the production of Low Carbon Cement, which has quickly gained popularity. SCG Cement and Green Solutions has accelerated the replacement of Low Carbon Cement with Portland Cement. In 2023, the production of Low Carbon Cement in place of Portland Cement increased to 63% from 41% in the previous year. Furthermore, adopting new, efficient, and green technologies, such as the CPAC Ultra Bridge Solution for ultra-thin high-performance concrete bridges and the CPAC 3D Printing Solution for flexible design, has reduced construction time, labor costs, material use, and waste. Additionally, SCG has grown its Green Circularity Business by creating value from waste materials and utilizing them to their fullest potential. This approach helps reduce production costs and lower greenhouse gas emissions.

SCG Smart Living continues to innovate in building materials, elevating living environment standards by developing energy-saving solutions, enhancing environmental hygiene, and increasing safety at home and building through smart technologies. Examples of these innovations include “SCG Bi-ion,” an ion-based air disinfection system that eliminates airborne pathogens, including dust particles; the energy-saving and improving indoor air quality “SCG Air Scrubber,” which can reduce air conditioning energy consumption by 20 - 30% in nonresidential building such as convention centers, shopping malls, hotels, and hospitals, which over 240 locations have installed these systems. “SCG Solar Roof Solutions” features the unique ‘Solar Fix’ installation system by SCG, preventing roof leaks from solar panel installations on roof tiles. “SCG Active Air Quality” ensures clean air inside homes by preventing pollution and pathogens from entering, filtering out PM2.5 particles by up to 99%, thus protecting indoor air from dust and pathogens. Furthermore, SCG has launched various new building material innovations that meet functional and design needs. The “SCG Metal Roof” with NoiseTECH technology cuts rain noise by up to 12 decibels compared to standard metal sheets. Using digital printing technology, the “SCG EXCELLA Cresta” ceramic roof offers distinctive natural stone patterns. Exterior fiber cement walls, “SCG WOOD-D,” mimic the pattern and colors of natural wood through digital printing technology, offering a durable alternative to real wood.

SCG Decor (SCGD), SCG has restructured COTTO to SCGD, and it has been listed on the Stock Exchange since December 20, 2023, to synergize its domestic and international operation; for instance, leveraging the cost competitiveness of its plant in Vietnam for an export base and doing sourcing activities across operations. SCGD aims to be No.1 in ASEAN market supported by our position as No.1 market share in ceramic tile and sanitary ware and fittings in Thailand and No.1 market share of ceramic tile in Vietnam and the Philippines, serving the four strategic markets which are Thailand, Vietnam, the Philippines, and Indonesia of over 560 million people with a market worth over 180 billion baht. The goal is to bolster its strengths by enhancing production efficiency in high-demand products, such as large tiles and SPC vinyl tiles. Efforts are underway to boost brand visibility across the region with brands such as COTTO in Thailand, PRIME in Vietnam, MARIWASA in the Philippines, and KIA in Indonesia and to broaden distribution networks for comprehensive regional coverage

SCG Distribution and Retail achieved the country’s strongest construction material distribution network, becoming a leader in ASEAN’s wholesale and retail sectors through digital technologies tailored to diverse customer needs to enable swift and precise business expansion. The business also offers end-to-end supply chain solutions, with a network across over 50 countries catering to both upstream and downstream demands. The goal is to improve the quality of life for business partners and customers worldwide. To actively expand into the retail market for construction and home decorative materials, the business increased its investment in PT Catur Sentosa Adiprana Tbk (CSA), Indonesia’s largest retail construction material business for “Mitra10” store expansion, aiming for 100 stores by 2030. It also invested in Caturkarda Depo Bangunan Tbk (CKDB), another leading retail store for construction materials, home decorative items, and garden supplies in Indonesia under Depo Bangunan brand to target sustained growth in the Modern Trade market. Additionally, SCG International is expanding its high-growth construction business in Saudi Arabia and India with an office in Saudi Arabia to become a “global leading trading partner”, forging connections with trading partners worldwide.

SCGP a subsidiary of Siam Cement Group (SCG), has been listed on the Stock Exchange since 2020 as a part of a strategy to restructure and increase agility, leading to sustainable growth. Sales climbed from 89,070 million baht in 2019 to 129,398 million baht in 2023. Amid challenges, SCGP has continuously grown through merger and partnership. In 2023, it invested in Bicappa Lab S.r.L., a major European medical supplies and labware manufacturer in Europe, to gain technological expertise and broaden its customer base in the medical supplies and labware market. Other investments include Law Print & Packaging Management Limited, a prominent packaging solution provider based in the UK specializing in the high-growth pet food industry, and Starprint Vietnam Joint Stock Company (SPV), a leading premium offset folding carton manufacturer in Vietnam. These investments have bolstered SCGP’s integrated packaging solutions, meeting the increasing demands of the customer base in ASEAN.

SCG Chemicals (SCGC), an ASEAN chemical industry leader, offers a comprehensive range of products from upstream to downstream. The vinyl business has further expanded into finished products, including pipes and fittings, enhancing the business’s strength. Despite the regular petrochemical trough every 7-10 years, SCGC has fortified its position by developing High Value Added Products & Services (HVA) to address megatrends like SCGC GREEN POLYMERTM. In 2023, sales reached 218,000 tons, on track for the 1 million tons per annum target by 2030. SCGC invested with Braskem in bio-based ethylene production from ethanol derived from agricultural produce-derived ethanol as an alternative to fossil-based ethylene with a 200,000-ton annual capacity. This bio-ethylene is used to produce bio-based polyethylene resins with a negative carbon footprint and are recyclable like conventional polyethylene to serve the high-demand markets in Asia and Europe. Partnering with Sirplaste in Portugal, SCGC expanded its high-quality recycled plastic resin production to 45,000 tons annually, focusing on odorless high-quality HDPE PCR resins for Europe. LSP, Vietnam’s first integrated petrochemical complex, despite the COVID-19 situation at the start of its construction, has proceeded as planned in terms of timeline and budget. It has begun downstream production since June 2023, with a total downstream production capacity of 1.4 million tons annually. It successfully commenced upstream operations in December 2023, aiming for full commercial production in early 2024. SCGC will strengthen its production bases in three markets: Thailand, Vietnam, and Indonesia, to create synergy from sourcing materials and production to sales.

SCG Cleanergy offers end-to-end clean energy services to the public sector, businesses, and industries, showing continuous growth. By Q4/2023, it has prepared and implemented ongoing projects with capacity totaling 451 megawatts. A notable achievement is implementing a smart grid system, already in use at Saha-Union Bangpakong and set to expand to the Phyathai-Paolo Hospital Group and Centara Hotels & Resorts. In partnership with the Provincial Electricity Authority, it has explored the feasibility of business models and the development of an energy trading platform for electricity trading within and outside industrial estates. Concurrently, it has invested in Rondo Energy, a U.S.-based clean energy startup, focusing on decarbonizing industrial use of fossil fuels through heat battery technology. This innovative technology converts electricity from clean sources into Green Thermal Energy to meet the industrial sector’s Net Zero ambitions. SCG, as a supplier, produces thermal media that stores heat at temperatures over 1,000 degrees Celsius, a key component of the Rondo Heat Battery.

The integrated logistics business has merged with JWD to form SCGJWD, synergizing strengths to create ASEAN’s largest integrated transportation and supply chain network. This venture offers comprehensive services across all industrial sectors, encompassing diverse transportation modes such as land, sea, rail, air, and cold storage. It also specializes in handling products like vaccines, pharmaceuticals, high-value artworks, automobiles, and hazardous materials, with a network extending across ASEAN and China. The business reported a gain of 11,956 million baht from the fair value adjustment of SCG’s investment in SCG Logistics following the merger with SCGJWD.

Other investment includes Addventures by SCG, a corporate venture focusing on investing in deep technology to tap into emerging science-based technologies worldwide. These advancements are leveraged to create innovative solutions for the ASEAN market, with investments targeting areas such as clean energy and decarbonization, industrial AI & automation to enhance production efficiency, and biotech, including biomaterials and bioactive substances. These efforts include investments in high-potential startups globally. Additionally, SCG has invested in the agricultural machinery business, automobiles, and automotive parts, among others.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Accelerating to Leverage Cost Advantage

Accelerating to Leverage Cost Advantage

|

|

|

|

|

| |

| |

|

|

|

|

|

SCG has improved energy efficiency in its production by boosting clean energy use, substituting fossil fuels to reduce greenhouse gas emissions, and lessen energy price volatility risks. It has embraced Renewable Energy (RE) sources, such as Waste Heat Power Generation (WHG), solar power energy, and Alternative Fuels (AF), to replace fossil fuels, with alternatives including biomass from agricultural waste, energy plants, and Refuse-Derived Fuel (RDF). Additionally, SCG uses supplementary cementitious materials as substitutes for clinker in the cement production process.

Adjusting raw material cost structures, SCGC has optimized low-cost material sourcing and adjusted its production processes to align with market conditions (Feed and Operation Optimization), increasing LPG, propane, and ethane use, especially from domestic sources, and finding lower-cost naphtha sources. SCGP has reduced paper pulp costs by optimizing recycled pulp ratios and has effectively managed paper pulp material costs by tailoring pulp formulas to different manufacturing needs.

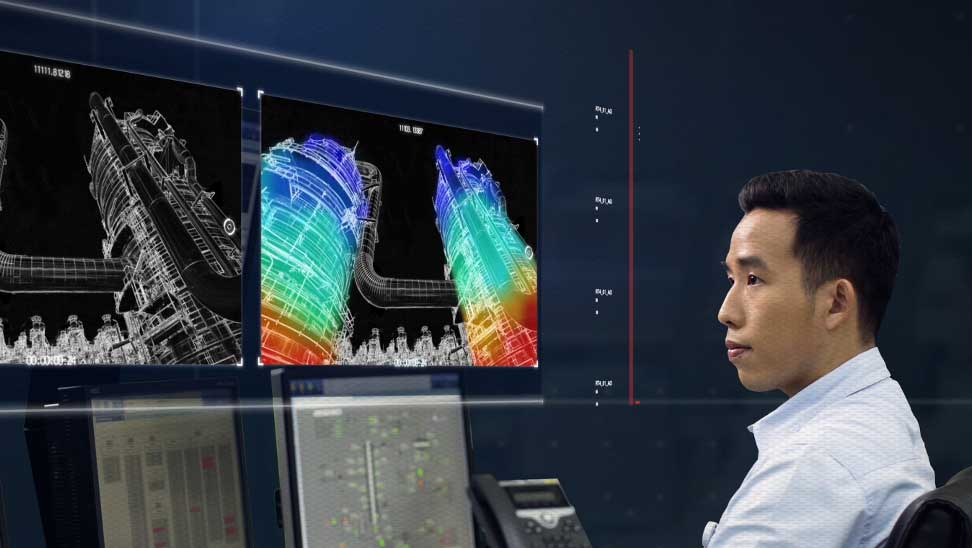

SCG is employing robotics and automation to reduce costs and administrative expenses. For example, the “CiBot” robot is employed to inspect material properties in coils within reactors, enabling safe, precise, and quick pipe condition assessments, reducing production costs and waste, benefiting both communities and the environment. Robotic systems are used to enhance automated manufacturing, automated material handling, automated packing, and stacking, transforming production into a Smart Factory, boosting planning efficiency at its maximum benefits, improving global competitiveness, and centralizing procurement through a Common Procurement Platform for cost savings.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Maintaining Financial Stability with a Robust Cash Flow of 68,064 Million Baht

Maintaining Financial Stability with a Robust Cash Flow of 68,064 Million Baht |

|

|

|

|

| |

| |

|

|

|

|

|

To counteract uncertainty, SCG prioritizes risk management, liquidity, financial discipline, and agile inventory management aligning with market demand, and carefully considers investment based on strategic potential for high returns and quick payback, including delaying non-urgent projects. As a result, SCG maintained a robust financial position at the end of 2023. The total revenue from sales was 499,646 million baht, a decrease of 12% from the previous year, while profit increased 21% to 25,915 million baht, mainly from a 14,822 million baht gain from investment value adjustments in the first half of 2023. In 2023, SCG’s sales of High Value Added Products & Services (HVA) amounted to 167,691 million baht, accounting for 34% of total sales. The net debt to equity ratio was 0.6 times, with stable cash flows of 68,064 million baht. As a result, the Board of Directors resolved to propose at the 2024 Annual General Meeting of Shareholders the approval of a full-year dividend payment of 7,200 million baht, or 6.0 baht per share, representing a payout rate of 54% of the profit excluding extra items. This comprised an interim dividend of 2.5 baht per shareand a final dividend of 3.5 baht per share.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Transforming the Business Landscape: Turning Crisis into Opportunity with Emphasis on ESG to Unite all Sectors in Accelerating Thailand’s Transition Towards a Low-carbon Society

Transforming the Business Landscape: Turning Crisis into Opportunity with Emphasis on ESG to Unite all Sectors in Accelerating Thailand’s Transition Towards a Low-carbon Society |

|

|

|

|

| |

| |

|

|

|

|

|

SCG is advancing with its ESG 4 Plus: Net Zero, Go Green, Reduce Inequality, Enhance Collaboration, Plus Trust through Transparency in all business operations. The goal is to achieve Net Zero greenhouse gas emissions (Scope 1 and 2) by 2050. In 2023, SCG cut its emissions (Scope 1 and 2) to 27.08 million tons of CO2, a 20.9% decrease from the base year of 2020, by adopting alternative energy, developing low-carbon products under SCG Green Choice. Elevating ESG as a National Agenda through the ESG Symposium 2023: Accelerating Changes Towards a Low-carbon Society, a proposal was presented to the Prime Minister, focusing on creating the Saraburi Sandbox as Thailand’s first low-carbon city model. Given Saraburi’s complex economic system encompassing heavy industries, agriculture, and tourism, it poses a complex and challenging transition into a low-carbon city. This initiative involves direct collaboration with relevant government sectors, real industry players, and affected communities to study success factors and limitations. If successful, this will motivate other provinces to follow suit. Initiatives include adopting Low Carbon Cement for construction projects in Saraburi starting from 2024, practicing alternate wetting and drying in paddy fields to lower water usage, planting energy crops like Napier grass, converting agricultural waste to alternative fuel, generating community incomes, and establishing 38 community forest networks. These efforts help restore community forests and boost eco-tourism. These actions complement efforts to drive a circular economy as a national agenda for sustainable economic growth, with initiatives already underway in the packaging, automotive, and construction industries.

Expanding the ESG Symposium’s collaboration to ASEAN, focusing on achieving Net Zero aligning with Nationally Determined Contribution (NDC) targets of Vietnam by 2050 and Indonesia by 2060, where SCG actively operates. In Vietnam, SCG partnered with the Thai business community and Vietnam’s Ministry of Natural Resources and Environment for the “Vietnam Circular Economy Forum 2023.” This forum, involving public, private, non-profit, academia, and circular economy experts, supports Vietnam’s circular economy roadmap to address economic, social, and environmental challenges. Meanwhile, the “ESG Symposium 2023 Indonesia” was held under the theme “Collaboration for Sustainable Indonesia,” aimed at achieving Net Zero emissions and reducing inequality, bringing together government, private sector, civil society, and youth to present visions, policies, and technological innovations.

In addition to this efforts are made to reduce social inequality by creating opportunities for education access, developing professional skills, and promoting good health. The development of professional skills has enabled the creation of a workforce that matches the market’s demands, benefiting 8,934 individuals. This includes initiatives like the Q-Chang platform, a hub for home service handymen, and the Thaksa Phiphat School for truck driver career development. Furthermore, the “Learn to Earn” project has been developed to foster careers for assistant nursing, dental assistants, and elderly caregivers.

|

|

|

| |

|

|

|

|

|

|

|

The Board of Directors would like to express its gratitude to all shareholders, debenture holders, joint-venture partners, suppliers, both domestic and international financial institutions, customers, and all stakeholders for their continued trust and support in SCG. This gratitude also extends to all SCG employees who have continuously adapted, dedicated themselves to creating innovations that satisfy customer needs, and collaborated with all sectors in taking care of society and the environment, adhering to transparent principles in line with the ESG approach moving forward.

Bangkok, January 24, 2024.

| |

|

|

|

|

Air Chief Marshal Satitpong Sukvimol

Chairman

|

|

Thammasak Sethaudom

President & CEO

|

|

|